UCB with progress on its growth path delivering value to patients and shareholders

Brussels (Belgium), 26 February 2016 – 7:00 (CET) – regulated information –

UCB Full Year Report 2015:

- Product growth drive top and bottom line growth – supported by exchange rates

- Kremers Urban divestiture increases financial and strategic flexibility

- R&D update: Briviact® (brivaracetam) for epilepsy approved in EU and U.S.; first Phase 3 study FRAME with romosozumab reports positive topline results; early pipeline strengthened

- Financial outlook 2016: Revenue expected at approximately € 4.0-4.1 billion, recurring EBITDA of € 970–1 010 million, Core EPS in the range of € 2.90-3.20.

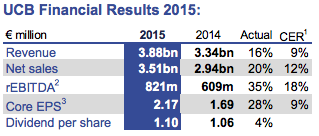

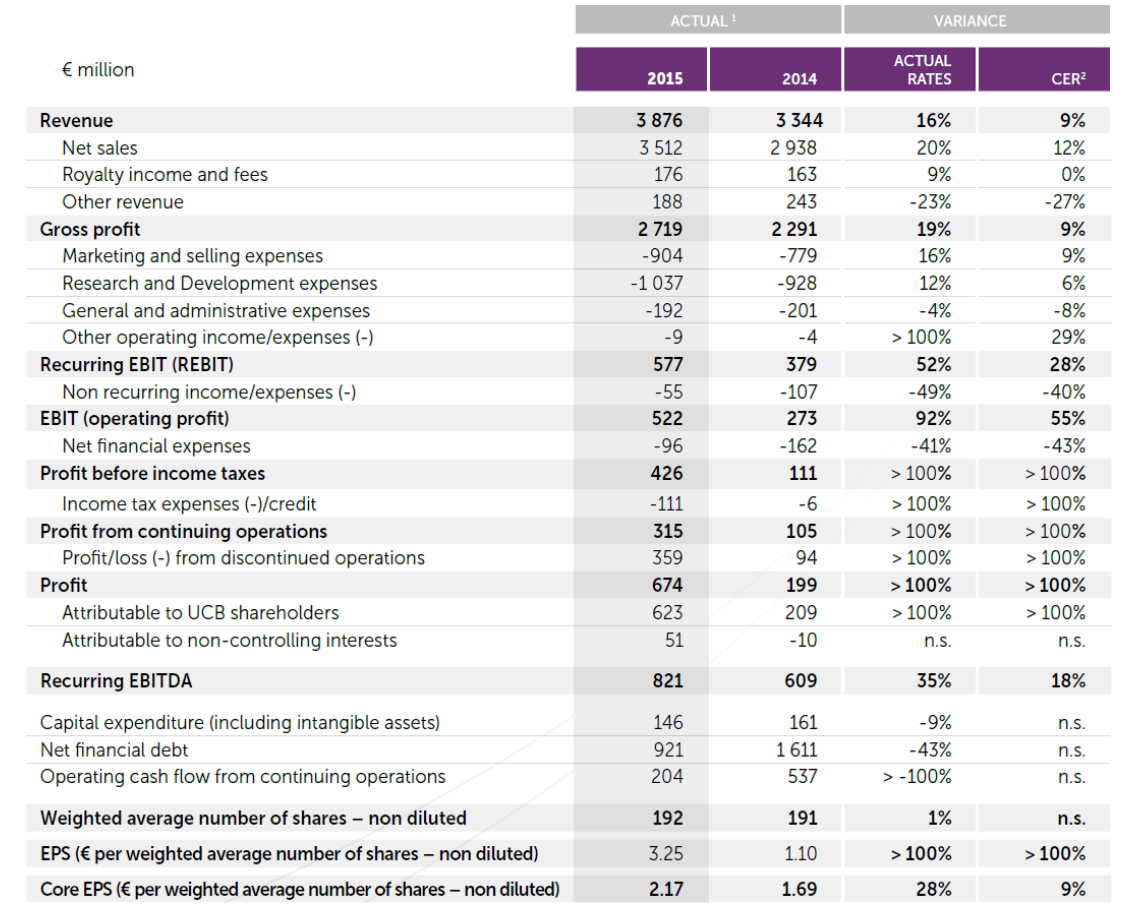

Underlying profitability –recurring EBITDA2- reached € 821 million (+35%; +18% CER), driven by strong net sales growth, higher gross margin and an under-proportional growth of operating expenses supported by tailwind from foreign exchange rates in 2015.

Non-recurring expenses were € 55 million after € 107 million, due to a gain from the divestiture of UCB's established brands in India. Net financial expenses went down to € 96 million from € 162 million, driven by lower interest expenses due to the pay-down of the outstanding retail bond which matured November 2014. Income tax expenses were € 111 million reflecting an average tax rate on recurring activities of 24%.

Profit from discontinued operations, reflecting the divestiture and activities respectively of Kremers Urban, reached € 359 million after € 94 million respectively. In September 2015, UCB entered a definitive agreement with Lannett to sell its U.S. specialty generics business, Kremers Urban. Upon closing of the deal in November 2015, UCB received approximately US$ 1.23 billion consisting of cash consideration of US$ 1.03 billion (subject to certain adjustments) and US$ 200 million senior unsecured notes issued to UCB by Lannett.

Profit of the Group was € 674 million and of which € 623 million is attributable to UCB shareholders and a profit of € 51 million to non-controlling interests. In 2014, € 199 million were attributable to UCB shareholders and a loss of € 10 million to non-controlling interests.

Core earnings per share, which reflect profit attributable to UCB shareholders after tax effects of non-recurring items, financial one-offs and amortization of intangibles, reached € 2.17 per share based on 192 million weighted average shares outstanding from € 1.69 per share based on 191 million shares in 2014 (+28%; +9% CER).

The Board of Directors of UCB proposes a dividend of € 1.10 per share (gross), an increase by four €-Cents or 4%.

Outlook 2016 - UCB expects continued growth. 2016 revenue should reach approximately € 4.0 - 4.1 billion; recurring EBITDA2 should increase to approximately € 970 - 1 010 million. Core earnings per share are expected in the range of € 2.90 - 3.20 based on an expected average of 188 million shares outstanding.

FY 2015 – Financial highlights

A full financial report on the consolidated results is available on the UCB website: http://www.ucb.com/investors/Financials/

- Due to rounding, some financial data may not add up in the tables included in this management report.

- CER : constant exchange rates

"The statutory auditor has issued an unqualified report with no emphasis of matter paragraph dated 25 February 2016 on the company’s consolidated accounts as of and for the year ended 31 December 2015, and has confirmed that the accounting data reported in the accompanying press release is consistent, in all material respects, with the accounts from which it has been derived."

For further information

Investor Relations

Antje Witte

Investor Relations, UCB

T +32.2.559.94.14 antje.witte@ucb.com

Isabelle Ghellynck,

Investor Relations, UCB

T+32.2.559.9588, isabelle.ghellynck@ucb.com

Corporate Communications

France Nivelle

Global Communications, UCB

T +32.2.559.9178 france.nivelle@ucb.com

Laurent Schots

Media Relations, UCB

T+32.2.559.92.64 Laurent.schots@ucb.com

About UCB

UCB, Brussels, Belgium (www.ucb.com) is a global biopharmaceutical company focused on the discovery and development of innovative medicines and solutions to transform the lives of people living with severe diseases of the immune system or of the central nervous system. With more than 7 700 people in approximately 40 countries, the company generated revenue of € 3.9 billion in 2015. UCB is listed on Euronext Brussels (symbol: UCB). Follow us on Twitter: @UCB_news

Forward looking statements

This press release contains forward-looking statements based on current plans, estimates and beliefs of management. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements, including estimates of revenues, operating margins, capital expenditures, cash, other financial information, expected legal, political, regulatory or clinical results and other such estimates and results. By their nature, such forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions which could cause actual results to differ materially from those that may be implied by such forward-looking statements contained in this press release. Important factors that could result in such differences include: changes in general economic, business and competitive conditions, the inability to obtain necessary regulatory approvals or to obtain them on acceptable terms, costs associated with research and development, changes in the prospects for products in the pipeline or under development by UCB, effects of future judicial decisions or governmental investigations, product liability claims, challenges to patent protection for products or product candidates, changes in laws or regulations, exchange rate fluctuations, changes or uncertainties in tax laws or the administration of such laws and hiring and retention of its employees.

Additionally, information contained in this document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such jurisdiction. UCB is providing this information as of the date of this document and expressly disclaims any duty to update any information contained in this press release, either to confirm the actual results or to report a change in its expectations.

There is no guarantee that new product candidates in the pipeline will progress to product approval or that new indications for existing products will be developed and approved. Products or potential products which are the subject of partnerships, joint ventures or licensing collaborations may be subject to differences between the partners. Also, UCB or others could discover safety, side effects or manufacturing problems with its products after they are marketed.

Moreover, sales may be impacted by international and domestic trends toward managed care and health care cost containment and the reimbursement policies imposed by third-party payers as well as legislation affecting biopharmaceutical pricing and reimbursement.

Asset Download

Stay up-to-date on the latest news and information from UCB