UCB Interim Report for the first three months of 2014: UCB with a good start into 2014

Brussels, Belgium – 24 April 2014 - 7:00am CEST– regulated information:

"UCB has started well in2014 - confirming the solid growth trends of our core medicines, Cimzia®, Vimpat® and Neupro®. We also continue good underlying growth in the emerging markets and Japan," said Roch Doliveux, CEO of UCB. "In addition to progressing our rich late state pipeline, we forged a new collaboration with Sanofi for breakthrough innovation to replace selected biologic agents with small molecules and thus benefit millions of people suffering from severe diseases.”

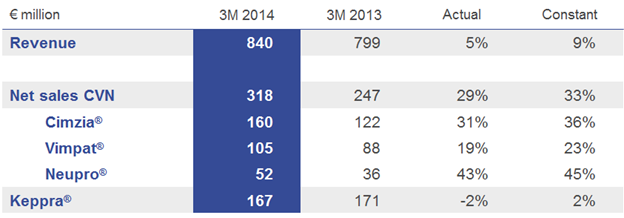

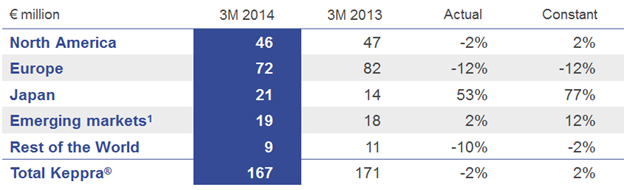

Total revenue in the first three months of 2014 reached € 840 million (+5%) driven by the 29% growth of Cimzia®, Vimpat® and Neupro® reporting combined net sales of € 318 million, which overcompensated the Keppra® decline of 2% to € 167 million, and the expected decline of allergy products in Japan as well as negative exchange rate effects. In the emerging markets1 and at constant currencies, net sales increased by a double-digit rate. In Japan, driven by UCB’s core medicines, net sales show strong growth when adjusted for the allergy franchise.

Financial outlook confirmed: 2014 revenue should grow to approximately € 3.5-3.6 billion; recurring EBITDA should increase to approximately € 740-770 million. Core earnings per share also reflect a higher number of shares and are therefore expected in the range of € 1.90 – 2.05 based on an average of 192 million shares outstanding. During the first quarter 2014, the full conversion of the convertible bond led to the issuance of 11 million new UCB shares, hence an increase in number of shares outstanding to 192 million .

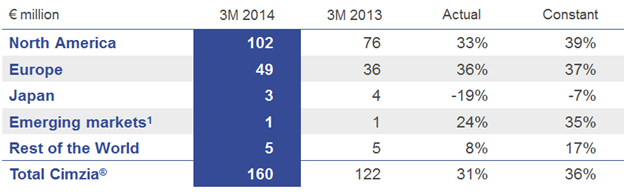

Cimzia® (certolizumab pegol) for inflammatory TNF mediated diseases continued its positive growth trajectory. During 2013, patient access has been broadened to patients in Japan (with partner Astellas) suffering from rheumatoid arthritis (RA), to patients in the U.S. suffering from active psoriatic arthritis (PsA) or active ankylosing spondylitis (AS) and patients in the EU with active psoriatic arthritis (PsA) or severe active axial spondyloarthritis (axSpA).

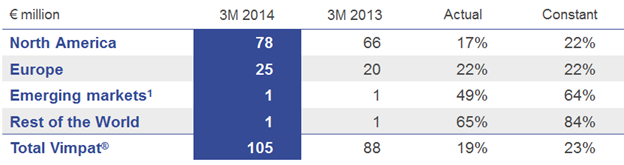

Vimpat® (lacosamide) for adjunctive therapy for epilepsy continued its growth trend. In the U.S., Vimpat® as monotherapy treatment in adult epilepsy patients with partial-onset seizures is under review by the regulatory authority. In Brazil, Vimpat® was approved earlier this year and is expected to be available to patients during the second half of 2014.

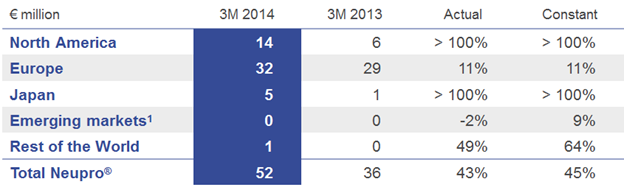

Neupro® (rotigotine), the patch for Parkinson’s disease (PD) and restless legs syndrome (RLS), grew by a strong 43% driven by the continued launch in the U.S. since 2012 and the launch in Japan in 2013.

Net sales of the anti-epileptic drug Keppra® (levetiracetam) held well at constant exchange rates. The post exclusivity erosion continues in both affected regions, with the U.S. declining at low single-digit rates and the EU at double-digit rates. In Japan - together with partner Otsuka, E Keppra® is showing strong growth.

Pre-clinical and clinical pipeline update:

In January, UCB and Biogen Idec signed exclusive agreements granting UCB the right to develop and commercialize medicines from Biogen Idec for the treatment of multiple sclerosis and hemophilia for patients in selected countries in South East Asia and China.

Breakthrough innovation collaboration in immune-mediated diseases with the goal to identify novel small molecule therapies to address a wide range of immune-mediated diseases: In March, UCB and Sanofi entered into a scientific and strategic collaboration for the discovery and development of innovative anti-inflammatory small molecules which have the potential to treat a wide range of immune-mediated diseases that are currently treated by biologic agents.

In March, UCB announced the return of the global rights to tozadenant (SYN115) for the treatment of Parkinson’s disease, to Biotie Therapies Corp. This portfolio decision by UCB is based on its promising early and late stage clinical development pipeline as well as preclinical opportunities and does not reflect any concerns regarding safety or efficacy of tozadenant.

For further information

- Antje Witte, Investor Relations, UCB

T +32.2.559.9414, antje.witte@ucb.com - Alexandra Deschner, Investor Relations, UCB

T: +32.2.559.9683, alexandra.deschner@ucb.com - France Nivelle, Global Communications, UCB

T +32.2.559.9178, france.nivelle@ucb.com - Laurent Schots, Media Relations, UCB

T +32.2.559.9264, laurent.schots@ucb.com

About UCB

UCB, Brussels, Belgium (www.ucb.com) is a global biopharmaceutical company focused on the discovery and development of innovative medicines and solutions to transform the lives of people living with severe diseases of the immune system or of the central nervous system. With 8 700 people in approximately 40 countries, the company generated revenue of EUR 3.4 billion in 2013. UCB is listed on Euronext Brussels (symbol: UCB).

Forward looking statements

This press release contains forward-looking statements based on current plans, estimates and beliefs of management. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements, including estimates of revenues, operating margins, capital expenditures, cash, other financial information, expected legal, political, regulatory or clinical results and other such estimates and results. By their nature, such forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions which could cause actual results to differ materially from those that may be implied by such forward-looking statements contained in this press release. Important factors that could result in such differences include: changes in general economic, business and competitive conditions, the inability to obtain necessary regulatory approvals or to obtain them on acceptable terms, costs associated with research and development, changes in the prospects for products in the pipeline or under development by UCB, effects of future judicial decisions or governmental investigations, product liability claims, challenges to patent protection for products or product candidates, changes in laws or regulations, exchange rate fluctuations, changes or uncertainties in tax laws or the administration of such laws and hiring and retention of its employees. UCB is providing this information as of the date of this press release and expressly disclaims any duty to update any information contained in this press release, either to confirm the actual results or to report a change in its expectations.

There is no guarantee that new product candidates in the pipeline will progress to product approval or that new indications for existing products will be developed and approved. Products or potential products which are the subject of partnerships, joint ventures or licensing collaborations may be subject to differences between the partners. Also, UCB or others could discover safety, side effects or manufacturing problems with its products after they are marketed.

Moreover, sales may be impacted by international and domestic trends toward managed care and health care cost containment and the reimbursement policies imposed by third-party payers as well as legislation affecting biopharmaceutical pricing and reimbursement.

Asset Download

Stay up-to-date on the latest news and information from UCB