UCB 2015 Half Year Report: Strong growth - at constant and actual exchange rates

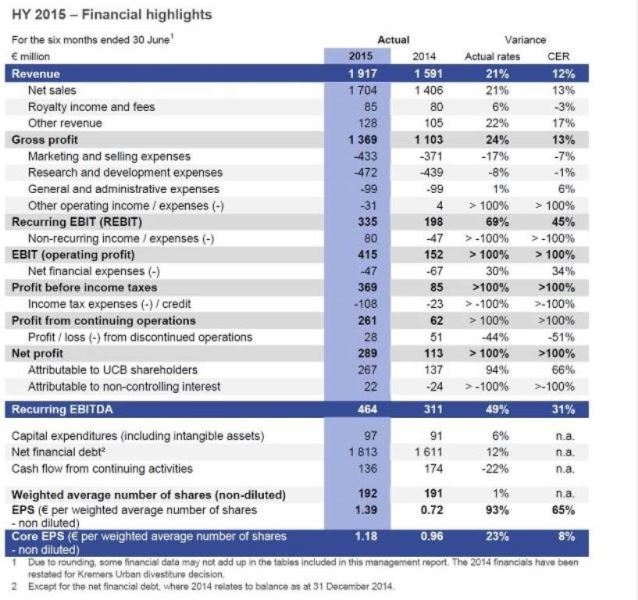

- Revenue of € 1 917 million, +21% or +12% at constant currency exchange rates (CER)

- Cimzia®, Vimpat® and Neupro® combined net sales of € 942 million (+40%; +23% CER) representing 55% of total net sales. Keppra® net sales of € 385 million (+14%; +2% CER).

- Underlying profitability (recurring EBITDA) reached € 464 million reflecting revenue growth, higher gross margin partnered with lower overall operating expense ratio in the first six months 2015.

- Net profit of the Group increased to € 289 million. Core earnings per share reached € 1.18

- R&D highlights: Vimpat® filed in Japan, epratuzumab Phase 3 studies in lupus did not meet primary endpoint, bimekizumab Phase 2a in combination with Cimzia® in rheumatoid arthritis started

- Financial outlook 2015 adjusted to reflect exchange rate effects: total revenue now expected in the range of €3.65 – 3.75 billion; recurring EBITDA at the higher end of the previous range of € 710-740 million; core earnings per share in the range of € 1.90 – 2.05

Brussels (Belgium), 31 July 2015 – 7:00 (CEST) – regulated information –

"We continue our growth path with strong growth from Cimzia®, Vimpat® and Neupro®, now accounting for 55% of UCB's net sales, and we are tracking well towards our profitability target of a 30% recurring EBITDA ratio in 2018," said Jean-Christophe Tellier, CEO UCB. "At the same time, we are very excited about the progress in our early pipeline, now encompassing seven projects in Phase 2 and 1. Our late stage development pipeline with brivaracetam under regulatory review and first Phase 3 results for romosozumab expected next year is tracking well. Although we are disappointed with the results from the Phase 3 studies for epratuzumab, our commitment to the lupus community remains. We are focused on developing new therapies for the treatment of immunological conditions."

Financial Performance in the first six months 2015

Total revenue reached € 1 917 million (+21%; +12% CER) and net sales grew to € 1 704 million (+21%; +13% CER) driven by tailwind from foreign exchange rates and the strong growth of UCB's core medicines, Cimzia®, Vimpat® and Neupro®, with combined net sales of € 942 million (+40%; +23% CER). UCB's core medicines represent now 55% of total net sales –78% for the U.S. and 45% for Europe. The Keppra® franchise reached net sales of € 385 million (+14%; +2% CER).

Cimzia® (certolizumab pegol) continued its growth path and showed net sales of € 490 million (+39%; +31% CER), supported by continuously broadened patient access to patients living with inflammatory TNF mediated diseases. In the U.S., Cimzia® reached € 321 million (+54%; 25% CER) and in Europe € 137 million (+29%; +27% CER).

Vimpat® (lacosamide) for epilepsy reached net sales of € 323 million (+49%; +27% CER). In the U.S., where since September 2014 Vimpat® is also available for monotherapy treatment of partial onset seizures, net sales were € 244 million (+58%; +29% CER). In Europe net sales were € 64 million (+23%; +22% CER).

For Neupro® (rotigotine), the patch for Parkinson’s disease and restless legs syndrome, net sales reached € 129 million (+26%; +18% CER). In Europe, growth of 9% led to net sales of € 73 million. In the U.S., net sales reached € 36 million (53%; 24% CER).

Net sales of the anti-epileptic drug Keppra® (levetiracetam) were € 385 million (+14%; +2% CER). The continued post-exclusivity erosion in Europe was compensated by growth in other markets.

Royalty income reached € 85 million (+6%; -3% CER). Other revenue increased to € 128 million (+22%; 17% CER), mainly due to milestone payments from UCB's partner for Vimpat® in Japan.

Gross profit went up to € 1 369 million (+24%, +13% CER), due to the net sales growth and improved product mix – the core products now representing 55% of UCB's total net sales. Operating expenses reached € 1 034 million, (+14%; +6% CER), showing a lower growth rate than the revenue line with reflecting marketing and selling expenses of € 433 million, research and development expenses of € 472 million and general and administrative expenses of € 99 million.

Underlying profitability -recurring EBITDA- reached € 464 million (+49%; +31% CER), driven by tailwind from foreign exchange rates, strong net sales growth, higher gross margin and an under-proportional growth of operating expenses.

Non-recurring income was € 80 million after expenses of € 47 million in the previous period, mainly due to a gain from the divestiture of UCB's established brands in India. Net financial expenses improved to € 47 million from € 67 million, mainly driven by lower interest expenses due to the pay-down of the outstanding retail bond which matured November 2014. Income tax expenses were € 108 million reflecting an average tax rate on recurring activities of 33% compared to 19% last year.

Net profit of the Group was € 289 million and of which € 267 million is attributable to the UCB shareholders and € 22 million to non-controlling interests. Last year, € 137 million were attributable to UCB shareholders and a loss of € 24 million to non-controlling interests.

Core earnings per share, which reflect net profit attributable to UCB shareholders after tax effects of non-recurring items, financial one-offs and amortization of intangibles, reached € 1.18 per share based on 192 million weighted average shares outstanding from € 0.96 per share based on 191 million shares.

Financial outlook 2015 adjusted to reflect exchange rate effects

UCB expects the continued growth of Cimzia®, Vimpat®, Neupro® to drive overall company growth. 2015 revenue is now expected in the range of € 3.65 – 3.75 billion; recurring EBITDA is now expected at the higher end of the previous range of €710-740 million. Core earnings per share (EPS) are expected in the range of € 1.90 – 2.05 based on an average of 192 million shares outstanding.

R&D update

In April, the Phase 3 program for Vimpat® (lacosamide) in primary generalized tonic-clonic seizures (PGTCS) has started; first headline results are expected in 2019.

In June, Vimpat® as adjunctive therapy in the treatment of adult patients with partial-onset seizures (POS) was filed with the Japanese agency.

In July, UCB0942 (PPSI), a small molecule in development for highly drug resistant epilepsy, started the Phase 2 proof of concept study; first results are expected Q4 2016.

In May, in addition to the ongoing Phase 2a trial with bimekizumab in psoriatic arthritis, a Phase 2a study to evaluate bimekizumab (UCB4940) in combination with Cimzia® in rheumatoid arthritis (RA) started. Headline results are expected H1 2017.

In June, The C-EARLY™ first phase (at 52 weeks) showed that adding Cimzia® to optimized methotrexate achieved sustained remission and low disease activity in this at risk patient population. Based on the results of this study, UCB submitted a regulatory application to the European Medicines Agency for an extension of the Cimzia® indication in RA.

Also in June, UCB's partnership with Vectura moved forward. The new molecular entity VR942 / UCB4144 entered Phase 1 in healthy volunteers and patients with asthma.

In July, UCB announced that the Phase 3 studies for epratuzumab in Systemic Lupus Erythematosus (SLE) did not meet the primary clinical efficacy endpoints. Treatment response in patients who received epratuzumab in addition to standard therapy was not statistically significantly higher than those who received placebo in addition to standard therapy. A high level review of the safety data did not identify any new safety concerns.

All other clinical development programs are continuing as planned.

"The statutory auditor has issued an unqualified review report dated 30 July 2015 on the company’s condensed consolidated interim financial statements as of and for the six month period ended 30 June 2015, and has confirmed that the accounting data reported in the press release is consistent, in all material respects, with the accounts from which it has been derived.”

A full financial report on the consolidated results is available on the UCB website: http://www.ucb.com/investors/Financials/Interim-reports

UCB will host a conference call/webcast at 08.00 (EDT) / 13.00 (BST) 14.00 (CEST)

Details available on http://www.ucb.com/investors/Half-year-financial-results

For further information, UCB:

Investor Relations

Antje Witte

Investor Relations, UCB

T +32.2.559.94.14 antje.witte@ucb.com

Isabelle Ghellynck,

Investor Relations, UCB

T+32.2.559.9588, isabelle.ghellynck@ucb.com

Corporate Communications

France Nivelle

Global Communications, UCB

T +32.2.559.9178 france.nivelle@ucb.com

Laurent Schots

Media Relations, UCB T+32.2.559.92.64

Laurent.schots@ucb.com

About UCB

UCB, Brussels, Belgium (www.ucb.com) is a global biopharmaceutical company focused on the discovery and development of innovative medicines and solutions to transform the lives of people living with severe diseases of the immune system or of the central nervous system. With more than 8500 people in approximately 40 countries, the company generated revenue of € 3.3 billion in 2014. UCB is listed on Euronext Brussels (symbol: UCB). Follow us on Twitter: @UCB_news

Forward looking statements

This press release contains forward-looking statements based on current plans, estimates and beliefs of management. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements, including estimates of revenues, operating margins, capital expenditures, cash, other financial information, expected legal, political, regulatory or clinical results and other such estimates and results. By their nature, such forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions which could cause actual results to differ materially from those that may be implied by such forward-looking statements contained in this press release. Important factors that could result in such differences include: changes in general economic, business and competitive conditions, the inability to obtain necessary regulatory approvals or to obtain them on acceptable terms, costs associated with research and development, changes in the prospects for products in the pipeline or under development by UCB, effects of future judicial decisions or governmental investigations, product liability claims, challenges to patent protection for products or product candidates, changes in laws or regulations, exchange rate fluctuations, changes or uncertainties in tax laws or the administration of such laws and hiring and retention of its employees.

Additionally, information contained in this document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such jurisdiction. UCB is providing this information as of the date of this document and expressly disclaims any duty to update any information contained in this press release, either to confirm the actual results or to report a change in its expectations.

There is no guarantee that new product candidates in the pipeline will progress to product approval or that new indications for existing products will be developed and approved. Products or potential products which are the subject of partnerships, joint ventures or licensing collaborations may be subject to differences between the partners. Also, UCB or others could discover safety, side effects or manufacturing problems with its products after they are marketed.

Moreover, sales may be impacted by international and domestic trends toward managed care and health care cost containment and the reimbursement policies imposed by third-party payers as well as legislation affecting biopharmaceutical pricing and reimbursement.

Asset Download

Stay up-to-date on the latest news and information from UCB