Transparency Notifications

1. Summary of the notifications

Pursuant to Article 14 of the law of 2 May 2007 on the disclosure of large shareholdings, UCB SA/NV announces that it has received one transparency notification dated 27 February 2017, from Wellington Management Group LLP (having its registered offices at 280 Congress Street, Boston, MA 02110, USA) and one transparency notification dated 28 February 2017, from BlackRock, Inc. (having its registered offices at 55 East 52nd Street, New York, NY, 10055, USA).

Wellington Management Group LLP has notified that, following an acquisition of UCB shares with voting rights by its affiliates, its shareholding in UCB SA/NV has increased and has crossed the 3% threshold on 23 February 2017.

BlackRock, Inc. has notified that, following an acquisition of UCB shares with voting rights by its affiliates, its shareholding in UCB SA/NV has increased and has crossed the 3% threshold on 27 February 2017.

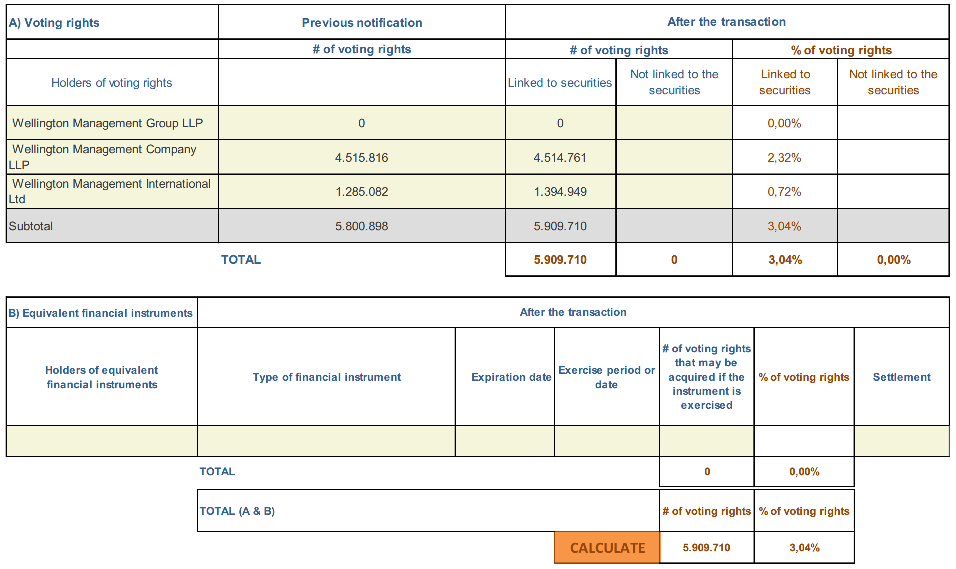

On 23 February 2017, Wellington Management Group LLP (taking into account the holding of its affiliates) owned 5 909 710 UCB shares with voting rights (versus 5 800 898 UCB shares in its previous notification dated 22 February 2017), representing 3.04% of the total number of shares issued by the company (194 505 658) (versus 2.98% in its notification dated 22 February 2017).

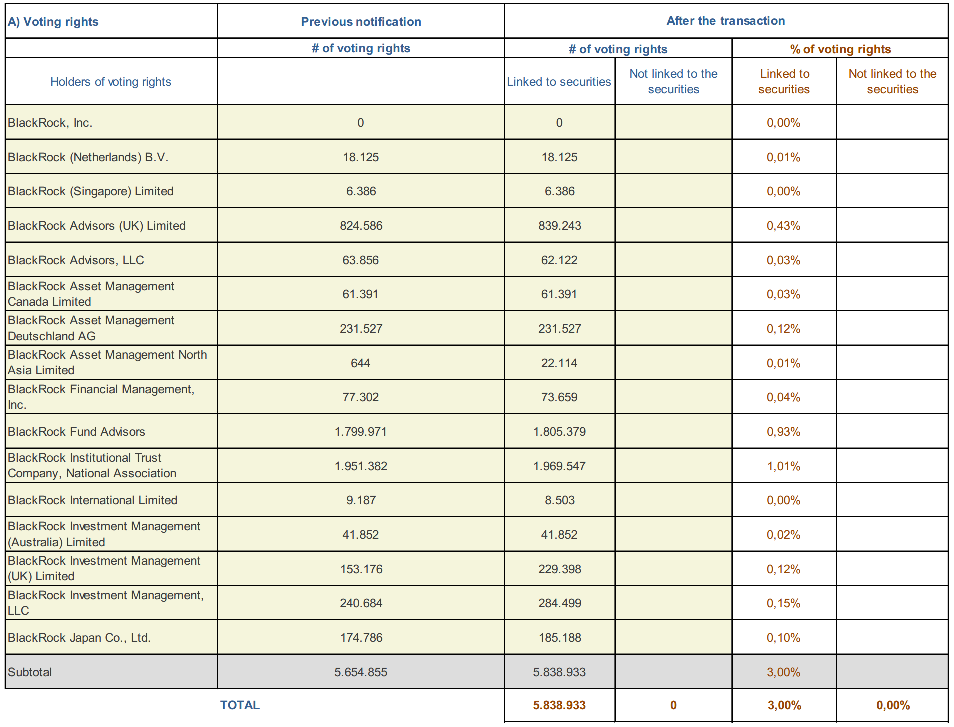

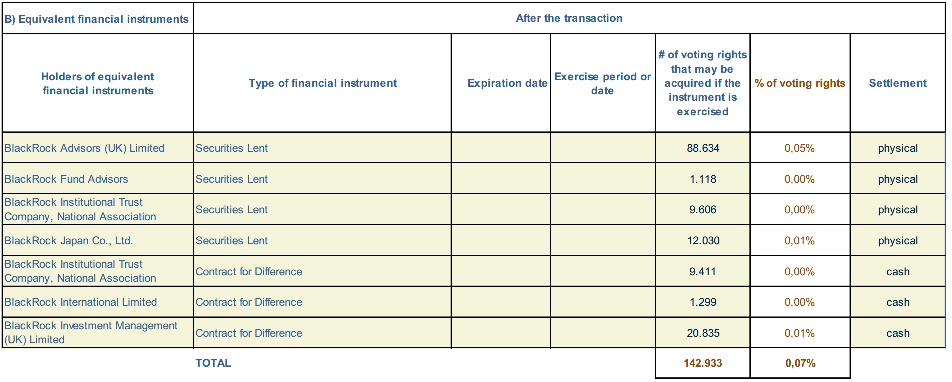

On 27 February 2017, BlackRock, Inc. (taking into account the holding of its affiliates) owned 5 838 933 UCB shares with voting rights (versus 5 654 855 UCB shares in its previous notification dated 23 February 2017), representing 3.00% of the total number of shares issued by the company (versus 2.91% in its notification dated 23 February 2017).

2. Content of the notifications

The transparency notification of Wellington Management Group LLP dated 27 February 2017 included the following information:

- Person subject to the notification requirement: Wellington Management Group LLP, 280 Congress Street, Boston, MA 02110 (USA).

- Date on which the threshold is crossed: 23 February 2017.

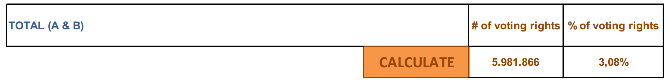

- Notified details:

- Chain of controlled undertakings through which the holding is effectively held: Wellington Management Company LLP is a direct controlled undertaking of Wellington Investment Advisors Holdings LLP, which, in turn, is a direct controlled undertaking of Wellington Group Holdings LLP, which, in turn, is a direct controlled undertaking of Wellington Management Group LLP.

Wellington Management International Ltd, is a direct controlled undertaking of Wellington Management Global Holdings, Ltd, which, in turn, is a direct controlled undertaking of Wellington Investment Advisors Holdings LLP, which, in turn, is a direct controlled undertaking of Wellington Group Holdings LLP, which, in turn, is a direct controlled undertaking of Wellington Management Group LLP. - Additional information: Wellington Management Company LLP is an investment management company and can exercise the voting rights at its discretion in the absence of specific instructions from the beneficial owners of the shares. Wellington Management International Ltd is an investment management company and can exercise the voting rights at its discretion in the absence of specific instructions from the beneficial owners of the shares.

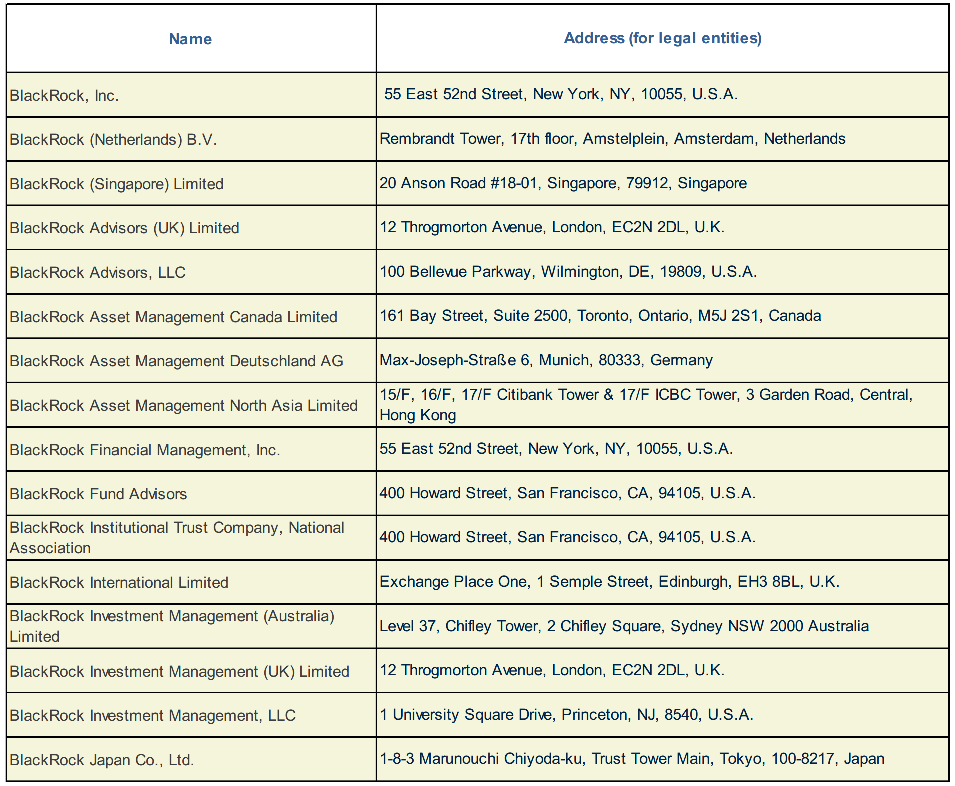

- The transparency notification of BlackRock, Inc. dated 28 February 2017 included the following information:

- Persons subject to the notification requirement:

- Date on which the threshold is crossed: 27 February 2017.

- Notified details:

- Chain of controlled undertakings through which the holding is effectively held: Please see the full chain of control in the PDF which is attached to the notification.

- Additional information: The disclosure obligation arose due to voting rights attached to shares for BlackRock, Inc. going above 3%.

The information mentioned hereafter was identical in both notifications:

- Reason for the notification: Acquisition or disposal of voting securities or voting rights.

- Notification by: A parent undertaking or a controlling person.

- Threshold crossed (in %): 3%.

- Denominator: 194 505 658.

3. Further information

This press release and the detailed transparency notifications are available on UCB SA/NV’s website via the following <a href="http://www.ucb.com/investors/Our-shareholders" class="" target="self">link</a>.

An updated overview of the UCB SA/NV large shareholdings will be available on UCB SA/NV’s website via the following <a href="http://www.ucb.com/investors/Our-shareholders" class="" target="self">link</a>.

Investor Relations

Antje Witte,

Investor Relations, UCB

T +32 2 559 94 14,

antje.witte@ucb.com

Isabelle Ghellynck,

Investor Relations, UCB

T +32 2 559 95 88,

isabelle.ghellynck@ucb.com

About UCB

UCB, Brussels, Belgium (www.ucb.com) is a global biopharmaceutical company focused on the discovery and development of innovative medicines and solutions to transform the lives of people living with severe diseases of the immune system or of the central nervous system. With more than 7 700 people in approximately 40 countries, the company generated revenue of € 4.2 billion in 2016. UCB is listed on Euronext Brussels (symbol: UCB). Follow us on Twitter: @UCB_news

Asset Download

Stay up-to-date on the latest news and information from UCB